florida estate tax limit

Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year. There is no inheritance tax or estate tax in Florida.

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

. The Save Our Homes property tax cap is an amendment to the Florida constitution that limits the annual increase in the tax assessment of homestead property to a maximum of 3 of the prior years assessment. If youre 65 or older who youve lived in Florida for at least 25 years you may be eligible for up to 100 percent property tax exemptions. Proper estate planning can lower the value of an estate such that no or minimal taxes are owed.

100 exempt from property taxes. In addition the state doesnt. Ad From Fisher Investments 40 years managing money and helping thousands of families.

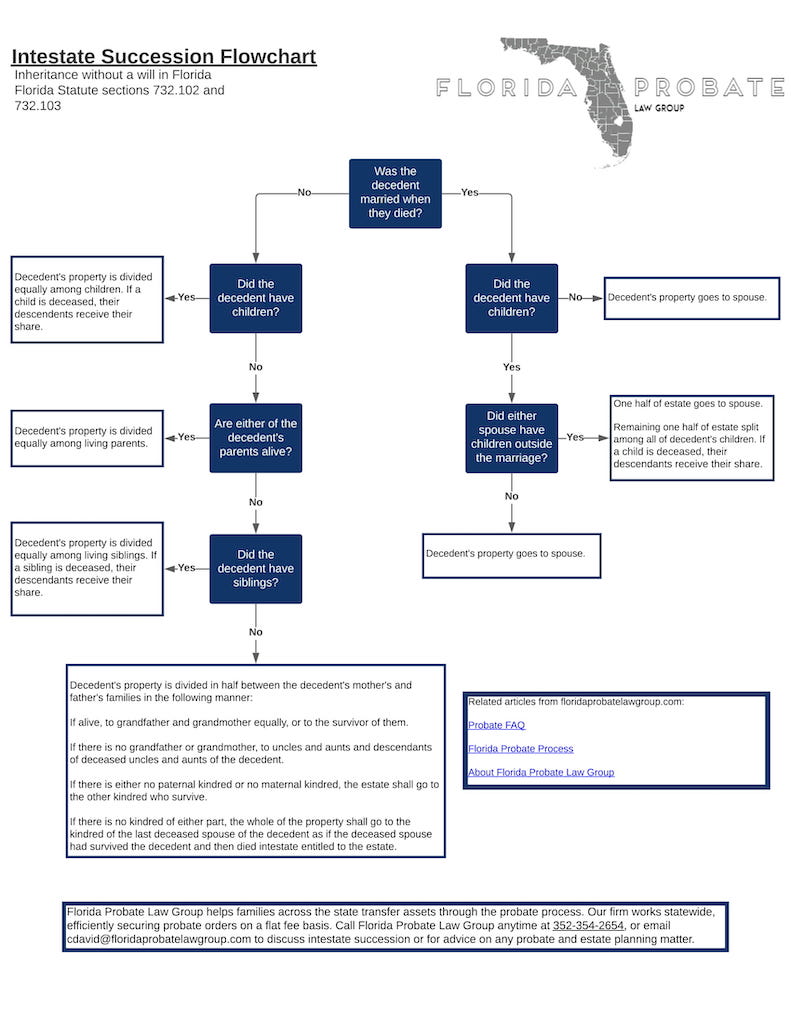

The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the lifetime limit 11700000 in 2021. Estate in Florida with a just value less than 250000 as determined in the first tax year that the owner applies and is eligible for the exemption and who has maintained permanent residence on the property for at least 25 years is 65 or older and whose household income does not exceed the household income limitation. This has to be recognized and addressed before the home is sold or the loss of portability will be permanent.

But Florida law. The income threshold for income taxes is six. In 2022 the estate tax threshold for federal estate tax.

There are some limits to this exemption though including. This year the maximum increase on the assessed value of a Homestead property in. This year the maximum increase on the assessed value of a Homestead property in.

The estate tax is a tax on an individuals right to transfer property upon your death. Even though Florida doesnt have an estate tax you might still owe the federal estate tax which kicks in at 117 million for 2021. Amendment 2 makes permanent the existing 10 cap on the annual increase in non-homestead.

Federal Estate Tax. The maximum amount your assessment can increase from one year to the next is 10. 097 of home value.

If an estate remains open for an extended time and produces income through rental properties or investments it may be subject to income tax. Florida is ranked number twenty three out of the fifty states in. As noted above the federal estate tax rate can climb to 40 depending on the size of your taxable estate.

Tax amount varies by county. Fully exempt from property tax. And its purpose is to encourage the preservation of homestead property and to ensure that Floridians will not lose their homes on the tax block because of.

The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023 And to find the amount due the fair market values of all the decedents assets as of death are added up. Theres no need to hold up the closingjust having the buyers and sellers sign a. Florida does not have an estate tax or income tax so the only taxes that can apply to a Florida estate are federal taxes.

If you purchase a non-homesteaded property any 10 assessment cap remains for the balance of the tax year in which the property was purchased. The value of the estate must be equal to or less than 75000 or. Florida DOR caps assessed value of Homestead properties.

The next 25000 the assessed value between. The exemption increased after the new tax legislation was signed in 2017. The decedent must have been dead for more than 2 years.

You must live in certain areas of the sate. Property Tax Exemptions Available to Limited-Income Seniors in Florida. What this means is that estates worth less than 117 million wont pay any federal estate taxes at all.

Florida estate tax limit. But if you transfer an estate valued at something higher than that upon death the federal government can tax a portion of the estate you leave behind before its transferred to the designated heirs. 65 and older with a disability rating.

Florida law limits annual increases in property value assessments on real property qualifying for and receiving a homestead exemption. TAMPA -- The 2022 limit for assessment value increases of Homestead property has been released by the Florida Department of Revenue FDOR. The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021.

The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021. The mid-2000s ushered in another wave of limitation measures perhaps explained by the fact that local government property tax revenues grew 50 percent faster from 2001 to 2005 than they did from 1996 to 2000. 10 or higher disability rating.

Additionally it called for providing a 25000 exemption for people who had not owned a. Luckily there is no Florida estate tax. Cell 813 955-2526TAMPA -- The 2022 limit for assessment value increases of Homestead property has been released by the Florida Department of Revenue FDOR.

And to find the amount due the fair market values of all the decedents assets as of death are added up. 6 Nationwide local property tax collections grew 36 percent in the first half of the decade while personal income grew 36 percent and. Depending on market factors your assessed value could increase less than 10 or could decrease.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Florida DOR caps assessed value of Homestead properties at 3 percent. 1 Any funds after that will be taxed as they pass.

Florida Estate Tax Limit. Florida law limits annual increases in property value assessments on real property qualifying for and receiving a homestead exemption. 100 permanently disabled Up to 500000 in property value is exempted Florida.

Its OK for the tax roll market value of a home to be up to 15 below the actual value but any more than that will cause the sellers portability to be lower than it should be. The Save Our Homes property tax cap is an amendment to the Florida constitution that limits the annual increase in the tax assessment of homestead property to a maximum of 3 of the prior years assessment. The proposal called for limiting the maximum annual increase in the assessed values of nonhomestead property to 5.

A Florida Property Tax Limit Amendment 3 initiative did not appear on the November 2 2010 ballot as a legislatively referred constitutional amendment. Discount on property taxes based on disability percentage. The non-homestead cap lets owners of second homes vacation homes and commercial properties such as rentals and vacant land limit their annual property tax to ten percent including school board assessments.

Renters business owners and consumers will be in for a major property tax increase if it fails to pass.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Florida Attorney For Federal Estate Taxes Karp Law Firm

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Inheritance Tax Beginner S Guide Alper Law

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022

Florida Homestead Exemption How It Works Kin Insurance

Should I Put My Florida Homestead In A Living Trust

Florida Homestead Exemption How It Works Kin Insurance

How Your Estate Is Taxed Or Not

![]()

Florida Inheritance Tax Beginner S Guide Alper Law

Florida Inheritance Tax Beginner S Guide Alper Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

Florida Estate Planning Guide Everything You Need To Know

Eight Things You Need To Know About The Death Tax Before You Die

Florida Property Tax H R Block

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm